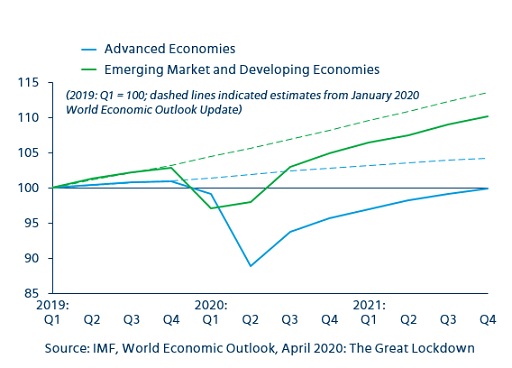

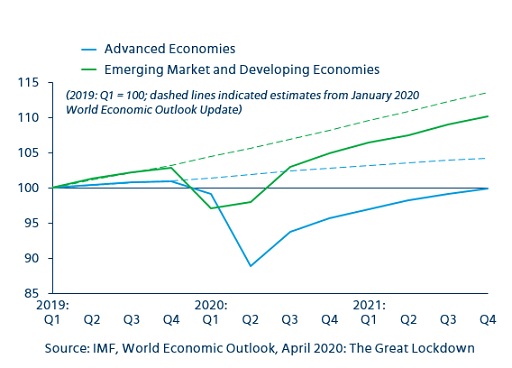

The latest economic indicators at the time of this writing (mid-June 2020) show economic conditions in the US, EU and Japan rapidly deteriorating due to the COVID-19 pandemic. Projections from the World Bank’s Global Economic Prospects predict a 5.2% decline in annual global growth in 2020, with a 7.0% decline projected for advanced economies — the worst performance since the Great Depression.[1] Economic activity may normalize in 2021 if the pandemic recedes in the second half of this year or if a vaccine is found and administered at scale. Nevertheless, as Figure 1 shows, forecasters do not expect the level of GDP in both advanced and developing economies to reach pre-pandemic projection[2] levels by the end of 2021.

Figure 1. Quarterly world GDP

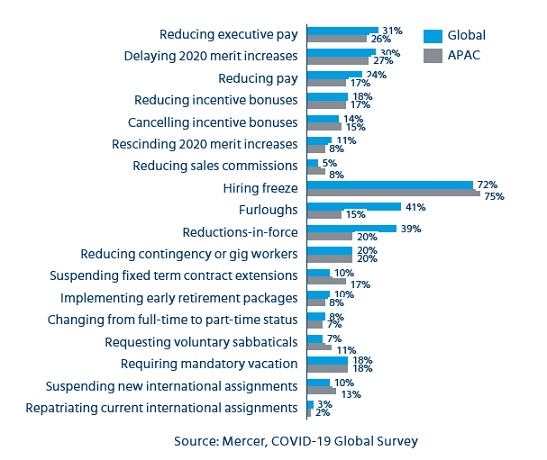

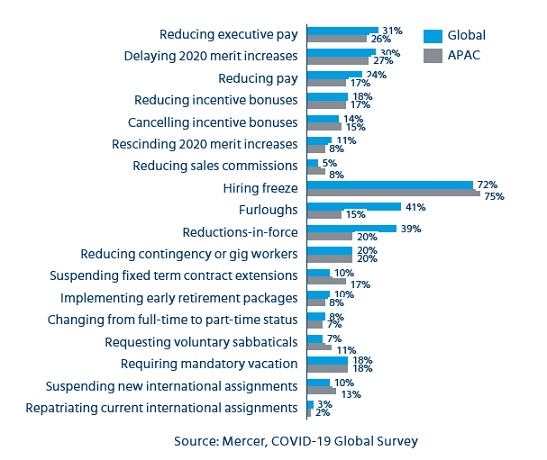

Under these challenging circumstances, companies have already taken aggressive cost-reduction measures. As shown in Figure 2, more than 70% of companies responding to a recent Mercer survey have implemented hiring freezes, and, globally, around 40% have announced furloughs and reductions in force. More than one in four companies has reduced executive pay, and 30% have delayed merit increases for 2020. In Japan, 33 companies have solicited voluntary separation (buyout) programs in the first five months of 2020, almost the same number (35 companies) as in all of 2019.[3]

Figure 2. Labor cost management measures

Mergermarket reports that M&A deals in Japan announced in the first quarter of 2020 reached US$13billion in value, up 55% from the same period last year. Although deal activity has slowed in the second quarter, the report suggests that Japanese companies may rekindle their willingness to engage in outbound M&A once the worst of the pandemic has passed. Especially given the stockpile of cash totaling US$4.8 trillion (as of September 2019) sitting on corporate balance sheets.[4]

A recent survey conducted by Intralinks supports this trend, showing that more than 40% of Japanese respondents anticipate deal flow recovery during the second half of 2020.[5] The survey also collects predictions of the types of deals expected to increase in the future. More than 90% of respondents expect an increase in “deals resulting from reorganization and restructuring in the industries which have been significantly impacted by COVID-19, such as tourism, food and beverage, transportation and retail.” Around 60% expect “business divestitures and asset deals by large public companies” to increase.

In the past, Japanese companies have mainly focused on mergers and acquisitions for strategic growth. Apart from separating unprofitable businesses, they haven’t engaged in aggressive review of business portfolio mixes or made strategic use of divestitures to generate cash and reinvest in faster-growing areas. The result has been slower growth and underperformance for many Japanese companies compared to their Western competitors.

In our experience, few Japanese companies adequately anticipate or proactively address the key people risks in such transactions. There are a few reasons for this, and, unfortunately, the current economic uncertainty, reduced timeframes and inability to travel will only make things worse.

First, companies often dismiss people risks as too conceptual or tactical to address strategically. As a result, they don’t spend enough time on change management and employee communications to get buy-in from the impacted employees. Second, companies spend limited time on organizational restructuring and standing up the business unit to make it easier to sell. Finally, Japanese headquarters, though often unfamiliar with local employment practices and legal requirements, may still hesitate to involve local management early in the deal.

Organizations looking to leverage divestitures as a way to stabilize their balance sheets and pursue new strategic imperatives must get smarter about people risks. They need to focus on understanding the impact the divestiture will have on the workforce — at both the remaining company and the carve-out — and deciding who stays and who goes. Determining retention strategies for key talent and putting together a strategic change management and communications plan will also be crucial. Finally, to ensure a smooth sale process, they must focus on executing the stand-up expectations (such as transition services agreement delivery, replication of employment terms and conditions, and stand up of compensation and benefits programs).

Early and strategic consideration of these elements will set the foundation for successfully mitigating risk and delivering value. While the future remains uncertain, organizations that can balance economics with empathy and adopt a people-centric approach will succeed in retaining top talent and realizing post-deal value.

[1] The World Bank. Global Economic Prospects, June 2020.

[2] IMF. World Economic Outlook, April 2020: The Great Lockdown.

[3] Tokyo Shoko Research. 5カ月で昨年1年にほぼ並ぶ、上場企業「早期・希望退職」 すでに33社が募集, June 2020, available at https://www.tsr-net.co.jp/news/analysis/20200602_02.html.

[4] Mergermarket. Deal Drivers: Japan — A Spotlight on Mergers and Acquisitions Trends in Q1 2020, May 2020.

[5] Intralinks. M&Aに関わるお客様への緊急サーベイ, May 2020, available at https://www.intralinks.com/sites/default/files/2020-05/intralinks-emergency-services-customers-ma-results-may-2020.pdf.