Sustainable Investment Opportunities

Potentially attractive returns from sustainable opportunities await the savvy investor as the world transitions to a sustainable, low-carbon economy.

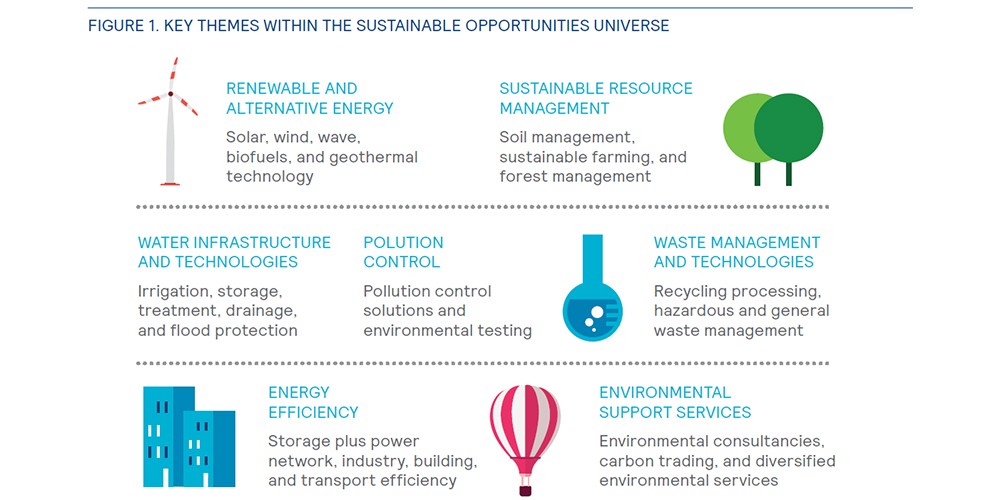

Sustainable opportunities are investments associated with ‘themes’ such as population growth, resource scarcity, and energy efficiency. They are opportunities that give institutional investors access to companies, assets, and projects (e.g. infrastructure projects) that can be expected to experience rapid and major growth in the near future as they tackle longer-term challenges inherent in population growth, resource scarcity, and energy efficiency. These are the opportunities now enhancing existing technology, developing new tech, and/or finding alternative solutions to the environmental problems we increasingly face.

In short, sustainable opportunities aim to capitalise on stronger demand for:

- Food, clean water, resources, and energy.

- More efficient ways to use and adapt technologies to reduce pollution and the harmful impact of a changing climate.

- Energy sources that no longer rely on high carbon, which cannot be sustained as the population and its appetite for energy rises.

A summary of the themes we have identified in the sustainable opportunities universe is shown in Figure 1 below.

Mercer has recognised the difficulties many investors face when seeking to effectively implement a sustainable opportunities portfolio directly. In response, we have developed our own sustainable opportunities portfolio to provide access to a diversified range of high-quality managers across the full range of sustainable themes, asset classes, and geographies.

Download our paper on ‘Investing in Sustainable Opportunities’ (right) to learn more and connect with a Mercer Investments consultant to explore how these opportunities could play out for the investment portfolios that you manage.

The most effective way to access sustainable opportunities is through private market investments, such as private equity, infrastructure, and sustainable natural resources (e.g. timber and agriculture). When building a private markets portfolio, we believe that diversification by manager, asset class, stage of investment (e.g. venture capital, growth capital), theme, and geography are critical to maximising benefits and minimising risks.

Thank you for your interest in Sustainable Investment Opportunities. If you do not have your pop-up blocker enabled, you will be prompted by your browser to download the article or to view it in a new window. In addition, you will receive an email from Mercer shortly with a link to access the PDF.