70% of millennials expect to keep working later in life to maintain their desired quality of life, while 2/3 of adults expect to live past 80, but only 1 in 3 expect to have enough money to afford it*. Longer life spans make for longer retirements. The average life expectancy for a 65-year-old male is an additional 19 years and an additional 22 years for a female of the same age, with a 25% chance of one person reaching age 97; and about a 5% chance of them living to age 100^.

Given today's market volatility and changed retirement landscape, having an insurance in place can help your clients address liquidity and protection needs, ensuring flexibility and the ability to cushion the impact of market volatility, while meeting their long-term goals and providing peace of mind.

Do you have clients who may have retirement savings reduced significantly as a result of the market turmoil; are averse to life insurance; have been declined or received unfavourable offers by insurers in the past due to their medical examination results; or are too old to go for medical examination but wish to leave something behind for their grandchildren?

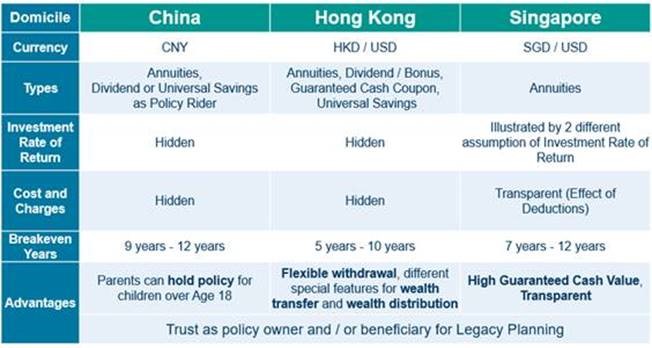

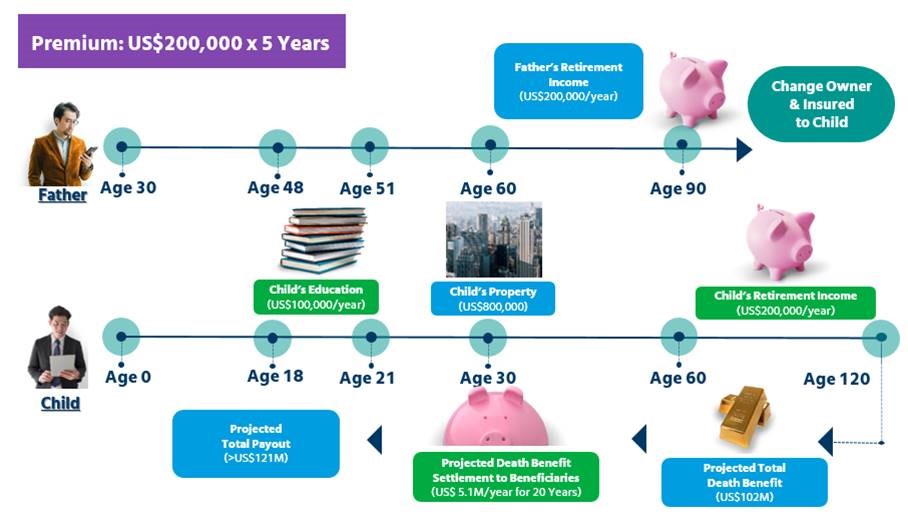

As an alternative asset class, Savings Plan is another insurance tool which can help your clients fulfill various key milestones and life’s goals including wealth accumulation, legacy planning, asset protection and retirement planning.

Source:

* https://www.mercer.com.sg/our-thinking/healthy-wealthy-and-work-wise.html

^ https://www.cnbc.com/2020/03/27/op-ed-with-market-volatility-4-percent-rule-creates-risk-for-retirees.html (best viewed on Chrome)